Introduction to Invoicing

Invoicing is an essential aspect of business transactions, playing a pivotal role in the relationship between service providers and clients. An invoice is a formal document issued by a seller to the buyer, detailing the products or services rendered, along with the amount due. This document is not merely a request for payment; it also functions as a legal record that can protect both parties in case of disputes or discrepancies.

The necessity of invoicing extends beyond mere paperwork. For service providers, an invoice serves as a crucial tool in tracking revenues and managing cash flow. It provides a clear outline of what services were provided and the respective costs, which is essential for maintaining accurate financial records. For clients, receiving an invoice ensures that they have a comprehensive account of what they are being charged for, lending transparency to the transaction.

Despite its significance, many individuals and businesses make common mistakes in invoicing. These errors can range from insufficient details on the invoice to miscalculations in the billing amount. Such mistakes can lead to delayed payments, misunderstandings, and strained relationships between the service provider and the client. Therefore, it is vital to create invoices that are clear, concise, and free from errors.

Sending a professional invoice not only enhances the credibility of the service provider but also prompts timely payments from clients. A well-structured invoice establishes the terms of the transaction, reinforces the professionalism of the business, and helps in building trust. In essence, understanding the intricacies of invoicing is crucial for anyone engaging in business transactions, ensuring a smoother and more efficient payment process.

Step 1: Determine the Invoicing Method

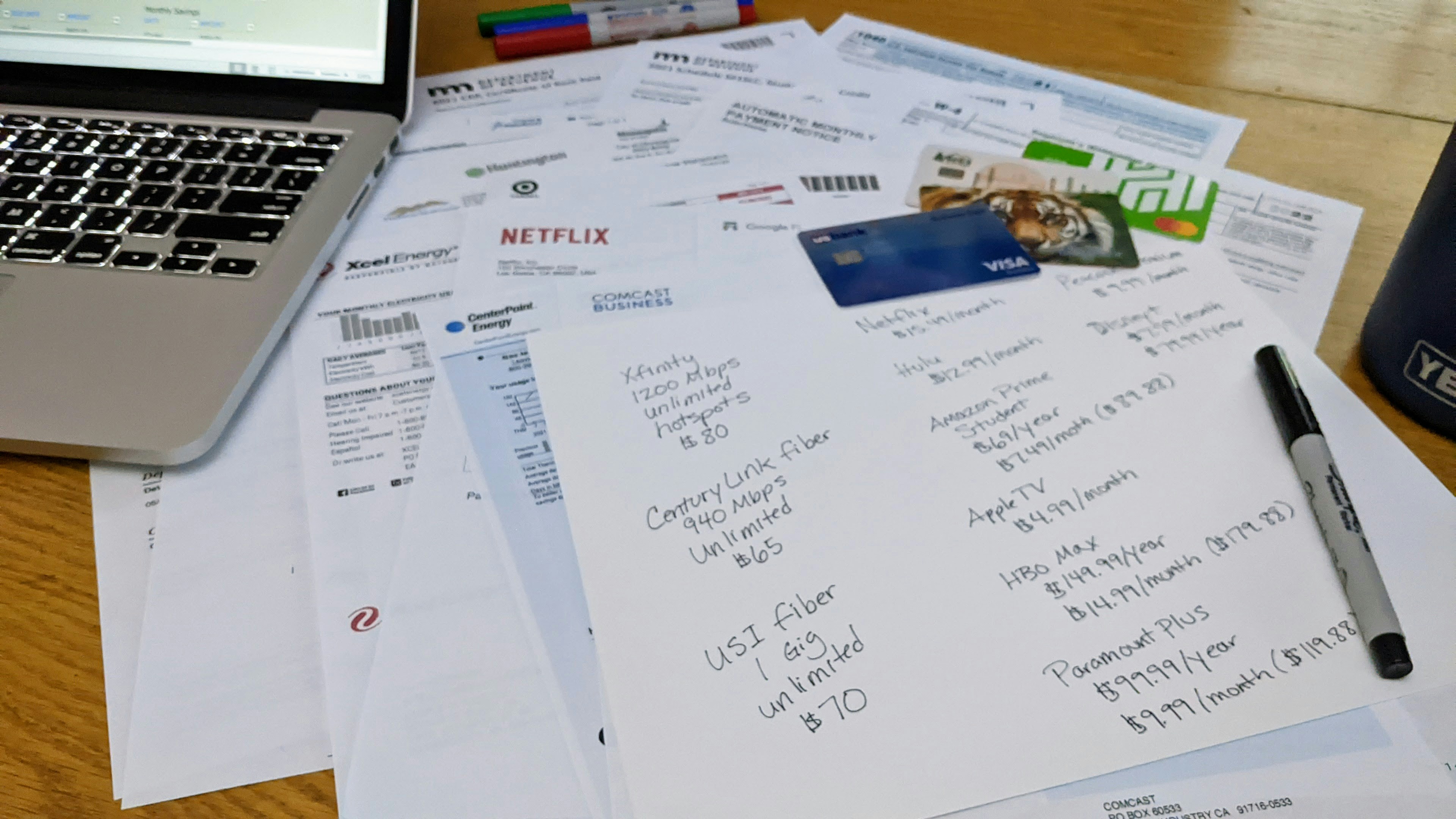

Choosing the appropriate invoicing method is crucial for ensuring that your billing process runs smoothly and efficiently. There are several invoicing methods available, each with distinct advantages and disadvantages. The most common options include traditional paper invoices, electronic invoices, and online invoicing software.

Traditional paper invoices are perhaps the most recognizable format. They can be printed and mailed directly to the client. One advantage of this method is its familiarity; some clients may prefer to receive a physical invoice as it provides a tangible record. However, this method can be slow, often leading to delays in payment. Additionally, shipping costs may add up, and managing physical documents can be cumbersome for both the sender and the recipient.

In contrast, electronic invoices provide a faster and more environmentally friendly alternative. These invoices are typically sent via email and can be created using standard word processing or spreadsheet applications. They allow for quicker transmission and receipt, often leading to faster payment cycles. However, not all clients may be comfortable with or have access to electronic invoicing, which could pose potential issues for outreach.

Another option is to use online invoicing software, which has grown increasingly popular in recent years. This type of software allows users to create and send invoices with ease while offering additional features such as expense tracking and automated payment reminders. Online invoicing platforms also often support integrations with accounting tools, streamlining the entire invoicing process. Although these services can incur subscription costs, they provide a comprehensive solution that enhances efficiency.

Ultimately, the choice of invoicing method should align with the specific characteristics of your business and the preferences of your clients. Consider factors such as the nature of your services, the typical transaction volume, and your clients’ inclinations towards digital or traditional methods. By carefully evaluating these aspects, you will be better equipped to determine the most effective invoicing method for your needs.

Create an Invoice Template

Creating a professional invoice template is essential for efficient and effective communication with clients. An invoice serves not only as a request for payment but also as an official record for both the service provider and the client. To begin crafting your template, start by including your business logo at the top. This element not only promotes your brand but also adds a touch of professionalism to your invoice. Make sure that the logo is clearly visible and appropriately sized to create an appealing aesthetic.

Next, prominently display your contact information, which should consist of your business name, address, phone number, and email. This information enables the client to reach out easily in case of any questions or disputes. Following your contact details, incorporate an invoice number. This unique identifier is critical for your accounting records, helping you and the client track payments efficiently over time.

Another essential component of your invoice template is the date of issue and the due date for payment. This clarity will facilitate timely transactions and reduce the likelihood of late payments. The itemized list of services or products should follow; it must clearly explain what the client is being charged for, including descriptions, quantities, rates, and the total amount due. A well-structured itemization not only enhances transparency but also helps prevent misunderstandings about charges.

When considering the design of your template, remember to maintain consistent branding. Choose an aesthetically pleasing color palette and font style that reflects your business’s identity. If creating a template from scratch seems daunting, numerous online platforms offer pre-made invoice templates that can be customized to fit your needs. These resources can save time and ensure you produce a well-crafted invoice that meets your professional standards.

Step 3: Fill Out the Invoice Details

Filling out the invoice details accurately is crucial for effective communication with your client and can help prevent disputes regarding payment. Start by entering the client’s name, address, and contact information prominently at the top of the invoice. This ensures the recipient knows exactly who the invoice is addressed to, thereby reducing any confusion.

Next, include a unique invoice number and the invoice date. The invoice number is important for tracking payments and should follow a logical sequence to help both you and your client manage records efficiently. While the invoice date provides a clear timestamp of when the invoice was issued, which may be relevant for payment terms.

Incorporate clear payment terms in your invoice details. This includes the total amount due, the due date, and acceptable payment methods. Clearly specifying these terms will help establish the timeline within which the client is expected to respond. Additionally, it can be beneficial to indicate any late fees that may apply if the payment is not received by the due date. This information promotes transparency and encourages timely payments.

A detailed breakdown of charges is equally important. List each service provided or product sold, alongside their corresponding fees. This not only clarifies what the client is being charged for but also avoids misunderstandings regarding the invoice totals. Including itemized details fosters trust and transparency in your business transactions.

Lastly, use clear and straightforward language throughout the invoice. Avoid jargon or ambiguous terms that may confuse the client. When the invoice details are well-articulated, it minimizes the chance of disputes and paves the way for positive client interactions regarding payment. Following these steps when filling out the invoice details can lead to smoother financial transactions and strengthen business relationships.

Step 4: Review and Verify the Invoice

Before finalizing and sending an invoice, it is crucial to conduct a thorough review and verification process. This step should not be overlooked, as small mistakes can lead to misunderstandings and potential payment delays. Begin by examining all details on the invoice, including the client’s name, address, and contact information to ensure accuracy. Mistakes in these fundamental elements can create confusion and tarnish professional relationships.

Next, scrutinize the items listed in the invoice. Ensure that the services provided or products sold are documented accurately, alongside their respective prices and any applicable taxes. This clarity will help mitigate disputes regarding the charges presented. Additionally, review the invoice dates—both the issue date and the payment due date—making sure they align with the terms agreed upon with the client.

One common error often overlooked in the invoicing process is mathematical inaccuracies. It is essential to verify that the totals align with the individual line items, discounts, and taxes. Utilizing spreadsheet software can aid in preventing arithmetic errors, as it typically features built-in formulas to ensure accuracy. Furthermore, double-check the payment terms and methods outlined in the invoice. Clear instructions on acceptable payment methods will simplify the process for your client, enhancing the likelihood of timely payment.

Lastly, consider seeking a second pair of eyes before sending out your invoice. This additional review can help spot errors that might have been missed during your preliminary checks. It is always beneficial to foster a culture of precision in financial dealings, which will ultimately uphold your professional credibility. By taking these measures, you minimize the risk of mistakes that could disrupt the professional relationship and financial transactions with your client.

Step 5: Send the Invoice to the Client

Once your invoice is prepared, the next essential step is to send it to your client effectively. There are several methods of delivery that you can utilize, each with its pros and cons. The most common approach is through email, which is not only quick but also allows for easy tracking of correspondence. When using email, it’s advisable to attach the invoice in a standardized format such as PDF, ensuring that the document remains intact and is easily accessible for the client.

Other delivery methods you might consider include traditional mail and invoicing software. If you opt for traditional mail, ensure that your invoice is printed clearly and sent to the correct address, allowing for sufficient time for delivery, particularly if deadlines are involved. Utilizing invoicing software can streamline the process significantly, as many programs offer clients the opportunity to view and pay invoices directly online. This method not only saves time but also provides immediate confirmation of receipt.

In addition to choosing the right delivery method, crafting a professional cover email or message is crucial. Your cover message should include a brief summary of the services rendered, the total amount due, and a polite reminder of the payment terms. Maintaining a polite and professional tone is important; it helps foster a positive relationship with your client and reinforces your professionalism. Express gratitude for their business and offer assistance should they have any questions about the invoice. This balanced approach can encourage prompt payment while also enhancing client satisfaction.

Step 6: Follow Up on the Invoice

Following up on an invoice is a crucial step in the billing process, as it can significantly enhance the likelihood of receiving prompt payment. After sending an invoice, it is essential to establish a timeline for follow-ups that aligns with typical payment periods agreed upon with the client. Generally, allowing a week or two from the invoice due date is a reasonable timeframe before initiating follow-up communication.

Effective follow-up strategies may include sending reminder emails or making phone calls. Reminder emails should be professional and courteous, reiterating the details of the invoice, including the amount due and the original due date. A gentle tone can help maintain a positive relationship with the client, while still emphasizing the importance of timely payment. For instance, an email could state, “I hope this message finds you well. I am following up regarding the invoice dated [invoice date], which was due on [due date]. If there are any questions or issues you would like to discuss, please let me know.” This approach keeps the lines of communication open and encourages dialogue regarding potential delays or concerns from the client’s side.

Phone calls can also serve as an effective follow-up method, offering the added benefit of immediate interaction. When opting for this method, it is vital to remain professional and understanding, as late payments can often stem from unforeseen circumstances. Approaching the client with empathy may foster goodwill and strengthen the working relationship. Moreover, it demonstrates your commitment to professionalism when discussing outstanding payments.

Ultimately, maintaining professionalism throughout the entire invoicing and follow-up process is paramount. By doing so, you protect your business’s reputation while ensuring clear communication and reinforcing the importance of timely payment with clients.

Step 7: Record the Invoice and Payment

Maintaining accurate records of invoices and payments is a critical step in the invoicing process, as it supports effective financial management and ensures compliance with tax regulations. Proper documentation aids in tracking cash flow, assessing business performance, and facilitates easier tax preparation. When an invoice is created and sent to a client, it is important to establish a systematic method for recording both the invoice itself and any subsequent payments received.

To effectively track invoices, businesses can utilize accounting software or spreadsheets to log essential details. Each record should include the invoice number, date issued, the total amount due, and the payment deadline. Status updates, such as whether the payment is pending or completed, should also be noted. This process not only helps in tracking outstanding invoices but also in managing follow-ups with clients who may delay payments.

When a payment is received, it is crucial to document the transaction promptly. This can be done by noting the payment date, amount received, method of payment, and any applicable transaction reference number against the invoice record. If applicable, receipts should be generated and sent to the client for their records, which not only confirms the payment but also builds transparency in the business relationship.

In addition to tracking invoices and payments, good bookkeeping practices are essential for overall business health. Regularly updating records ensures that financial data is accurate and readily available for analysis. This diligence allows businesses to evaluate their income and expenses, prepare for tax season, and make informed decisions regarding budgeting and financial forecasting. Comprehensive records also provide a defense in case of any disputes or audits.

Conclusion

In summary, effective invoicing is paramount for maintaining solid relationships with clients while ensuring that payments are received in a timely manner. Throughout this guide, we have explored seven essential steps for crafting a successful invoice. These steps not only streamline the invoicing process but also promote professionalism and clarity in financial transactions. By implementing these strategies, businesses can enhance their reputation and reliability in the eyes of their clients.

The importance of accuracy and detail in invoicing cannot be overstated. A well-structured invoice that includes all necessary information—such as services rendered, payment terms, and clear due dates—can significantly reduce the likelihood of payment delays. Moreover, maintaining open lines of communication with clients regarding invoices can foster trust and facilitate smoother transactions.

Additionally, embracing these invoicing practices contributes to improved cash flow, which is vital for any business. Timely payments are crucial for covering operational expenses and investing in growth opportunities. By adopting a systematic approach to invoicing, businesses can avoid cash flow issues and focus on expanding their services or products.

As we consider the steps outlined in this article, it becomes clear that the invoicing process serves as a foundation for financial health in any business. Fostering good invoicing habits today will undoubtedly pay dividends in the future. Encourage yourself and your team to adopt these best practices for invoicing, and witness the positive impact on client satisfaction and overall business performance.